How Eureka Fintech Streamlines KYC Processes

- Eward SHEN

- Dec 7, 2022

- 4 min read

Updated: Dec 8, 2022

Isn’t it surprising to see growing compliance department in banks, while most back-office departments are being downsized by utilizing technology to streamline and automate business processes?

Across the globe regulators are tightening their compliance framework in an effort to combat money laundering. But due to the complexity of the financial industry, every country having their own rules and regulations, the industry is required to consistently invest to meet those requirements. Business processes involving AML/KYC have become very time-consuming and labour-intensive as banks handle an explosive amount of data. While rule-based AML systems help identify suspicious transactions, unfortunately they also generate false alerts, that require the same amount of time and effort of investigators to review.

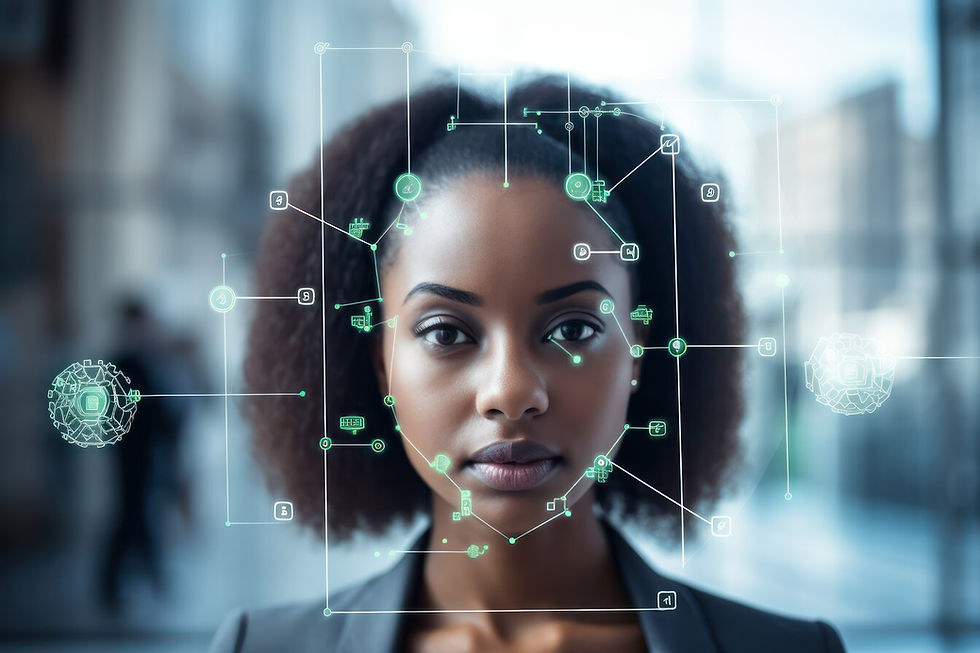

Eureka Fintech founder, Professor Hwa-Ping Chang, has decades of experience working with financial institutions who face this thorny issue. Using Natural Language Processing ("NLP"), Graph Technology, and Big Data, Professor Chang has been working on developing a human-centric AML/KYC platform.

This week QIDS Managing Partner Edward Shen sits down with Professor Chang of Eureka Fintech to discuss his vision and mission of fighting financial crimes alongside financial institutions and regulators. This article is also available on LinkedIn.

Edward: What is Eureka FinTech’s story?

Professor Chang: While leading the Greater China team at an international bank, I spent a considerable amount of time and effort on AML/KYC issues. KYC processes are siloed across multiple departments and cannot keep up with the growing complexity. As a result, Eureka Fintech was founded and a team of professionals with diverse expertise and experience in the financial industry and tech companies was put together to develop a tech-enabled solution to streamline AML/KYC investigations.

Edward: Speaking of AML/KYC, can you briefly explain what is money laundering and why it is important?

Professor Chang: In a special report prepared by the European Court of Auditors, it defines money laundering as the practice of “legitimising” the proceeds of crime by filtering them into the regular economy to disguise their illegal origin.

Now why is AML / KYC important – very simple, there are billions of reasons! Let me quote again from the same report from the European Court of Auditors: “Within Europe, Europol estimates the value of suspicious transactions in the hundreds of billions of euros – at an equivalent of 1.3 % of the EU’s gross domestic product (GDP). Global estimates are close to 3 % of world GDP.”

Edward: What are main pain points in the AML/KYC process?

Professor Chang: The AML/KYC process involves analysing complicated relationships between entities and individuals, such as ownership, directorships, guarantees, and supply chains. AML/KYC also requires the monitoring of dynamic data sources, such as company announcements and press releases, which are not available from static data sources like WorldCheck, LexisNexis, or Dow Jones.

The use of legacy investigation processes to deal with AML/KYC cases is similar to using a static two-dimensional map to understand the real world, which is three-dimensional plus time.

As a result, Eureka Fintech developed a 4-Dimensional software that solves this complicated business challenge for financial institutions. This flexible and automated software is branded as the “4D KYC” platform.

Edward: So what exactly is the Eureka 4D KYC platform doing?

Professor Chang: Our mission is to provide financial institutions, manufacturers and businesses across Asia with an innovative KYC solution that can simplify and automate AML/KYC checks, quickly analyses huge amount of data and thereby enhances and streamlines the entire compliance process.

First of all, 4D KYC fully integrates the banks' internal data with other data from third party vendors. Eureka Fintech has been seamlessly collaborating with third party data vendors in Mainland China and Taiwan. Currently we are expanding the partnership to other regions including Hong Kong, Japan, and Malaysia etc. Furthermore, 4D KYC can also utilise alternative data (or unstructured data) extracted from multi-media and processed by NLP to complement structured data. As a result, 4D KYC substantially improves efficiency and reduces the manual workload.

Eureka Fintech not only provides more complementary data, but also offers highly automated KYC tools that can save banks tremendous amounts of time. On average, 4D KYC can perform tens of thousands of AML checks within a few minutes. In the past, bank analysts needed several days to process the same amount of data.

Edward: Why is the 4D KYC platform so compelling to users?

Professor Chang: Eureka Fintech's 4D KYC helps users save time and offers more insight into AML cases. In English there is the expression “a picture is telling more than 1000 words”. The same applies to business and AML/KYC - showing something complex in a picture or graph is very intuitive and helpful.

On our 4D KYC platform we are utilising Graph Technology as a powerful tool to link internal or external data, fast computations using Big Data and NLP with user-friendly and intuitive visualisation.

As a result, our 4D KYC platform helps the AML analysts to instantly understand multiple layers of relations between accounts. Time consuming tasks like going through hundreds of pages of documents, searching the web etc. are being reduced to a minimum. The KYC/AML analyst can spend the time on tasks where his years of experience are really required.

Edward: Is KYC only important for banks?

Professor Chang: No, due diligence is an integral part of corporate risk management and provide businesses with a first layer of protection. A very simple example – you are a European manufacturer and you want to buy some machine parts in China. How do you ensure the Chinese company is legitimate? Very simple – you can use our 4D KYC platform.

So the 4D KYC platform can also be used by all corporates to identify and assess risks along the supply chain. A chain is only as strong as its weakest link, so companies should identify and mitigate supply chain vulnerabilities. As a Software-as-a-Service (“SaaS”) platform, 4D KYC is enterprise ready and offers both annual subscription packages and pay-as-you-go plans, so companies can adopt the platform easily with no implementation cost and lead time.

Edward: Thank you so much for taking the time to introduce us to Eureka Fintech, the mechanics of 4D KYC, and how we can support financial institutions in addressing their related AML/KYC concerns.

QIDS Venture Partners is dedicated to supporting and catalysing the developments in Fintech by sharing with our audience Fintech trends and interesting Fintech business ideas. You may forward this article to other investors who are interested in Fintech as well. If you need more information or would like to arrange a meeting with us, please feel free to contact our Managing Partner Edward Shen via LinkedIn or email.

Comments